Our Belief

A significant portion of India's rural population (76%) lacks a clear understanding of basic financial concepts. As the country transitions to a digital economy, vendors, farmers, and underprivileged sections struggle to adapt to new systems like online payments, leaving them vulnerable to scams and banking fraud. Financial literacy is crucial for economic resilience and empowerment. At Wingify Foundation, we believe that providing accessible financial education will bridge the gap between traditional practices and the digital economy, empowering street vendors and underprivileged communities. We aim to ensure no one is left behind in India’s economic progress.

Our Playground

Our program targets diverse settings across India, focusing on street vendors in Delhi and underprivileged communities nationwide.

1. Street Vendors in Delhi

We aim to empower women street vendors in Delhi, who face challenges managing finances and adopting digital payment methods.

2. Underprivileged Communities and Farmers

Beyond Delhi, we focus on farmers, domestic workers, and street hawkers across rural India, equipping them with practical financial skills and knowledge about government schemes, loans, and investments.

Reach, Methods, and Approach

1. Surveying Women Street Vendors

We assess financial literacy gaps by conducting surveys in Delhi, and gathering data on vendors’ financial practices and needs. This helps us tailor training modules on topics like digital payments and savings habits.

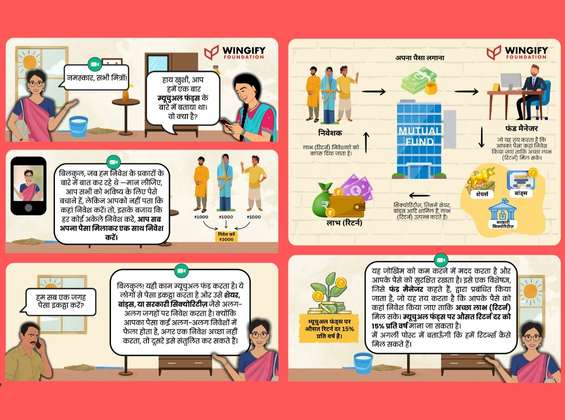

2. Financial Literacy Content Creation

Engaging, accessible content will be created based on survey findings, including videos, memes, blogs, and guides. We’ll cover topics like government schemes and digital payment systems to address community-specific challenges.

3. Digital Outreach and Financial Literacy Workshops

Workshops will cover financial management, sustainable entrepreneurship, and cyber fraud prevention. Post-training, WhatsApp groups will reinforce learning by sharing bite-sized information In addition, we’ll provide handholding using various digital platforms.

Expected outcomes

- Increased financial awareness among women vendors.

- Better use of digital payment systems.

- Improved personal and business finance management.

- Greater access to formal banking and savings.

- Enhanced understanding of budgeting, saving, and investing.

- Increased engagement with government financial schemes.

- Improved decision-making for financial stability.

Impact

- Economic Empowerment: Vendors will grow their businesses and improve their economic standing.

- Digital Inclusion: Reducing vulnerability to fraud by bridging the digital gap.

- Community Development: Knowledge will spread within communities, creating a ripple effect.

- Gender Equality: Empowering women to take control of their financial futures.

- Financial Stability: Improved money management and reduced inequality.

- Increased Utilization of Financial Products: Greater access to government schemes and banking services.

- Cultural Shift: Fostering financial literacy for long-term economic growth.

- Reduction in Exploitation: Protecting individuals from fraud and scams with enhanced financial knowledge.